整理了2011年6月份ACCA考試《F6稅務(wù)》大綱,該大綱和學(xué)習(xí)指南旨在幫助考生規(guī)劃學(xué)習(xí),并為每一部分的考點(diǎn)提供詳細(xì)的信息。

AIM

To develop knowledge and skills relating to the PRC tax system as applicable to individuals, domestic enterprises and foreign invested enterprises.

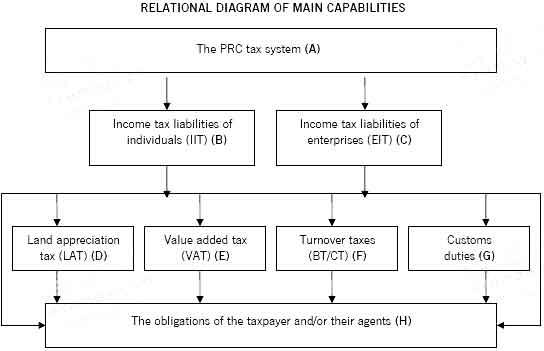

MAIN CAPABILITIES

After completing this examination paper students should be able to:

A Explain the operation and scope of the PRC tax system

B Explain and compute the income tax liabilities of individuals

C Explain and compute the income tax liabilities of corporate enterprises

D Explain and compute the effects of land appreciation tax for individuals and enterprises

E Explain and compute the effects of value added tax for individuals and enterprises

F Explain and compute the effects of turnover taxes (business tax and consumption tax) for individuals and enterprises

G Explain and compute the effects of customs duty on the business transactions of individuals and enterprises

H Identify and explain the obligations of tax payers and/or their agents and the implications of non-compliance.

RATIONALE

This syllabus introduces candidates to the subject of taxation and provides the core knowledge of the underlying principles and major technical areas of taxation,as they affect the activities of individuals and businesses.

In this syllabus,candidates are introduced to the rationale behind and the functions of the tax system.The syllabus then considers the separate taxes that an accountant would need to have a detailed knowledge of,such as the income tax liabilities of individuals,domestic corporate enterprises and foreign invested enterprises;the value added tax and turnover tax liabilities of businesses;and the land appreciation tax arising on disposals of property by both individuals and enterprises.

Having covered the core areas of the basic taxes,the candidate should be able to compute tax liabilities,explain the basis of their calculations,apply tax planning techniques for individuals and companies and identify the compliance issues for each major tax through a variety of business and personal scenarios and situations.

AIM

To develop knowledge and skills relating to the PRC tax system as applicable to individuals, domestic enterprises and foreign invested enterprises.

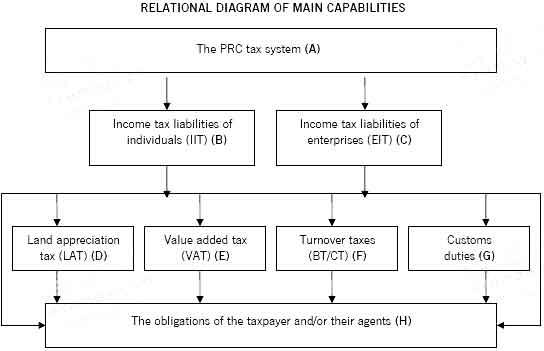

MAIN CAPABILITIES

After completing this examination paper students should be able to:

A Explain the operation and scope of the PRC tax system

B Explain and compute the income tax liabilities of individuals

C Explain and compute the income tax liabilities of corporate enterprises

D Explain and compute the effects of land appreciation tax for individuals and enterprises

E Explain and compute the effects of value added tax for individuals and enterprises

F Explain and compute the effects of turnover taxes (business tax and consumption tax) for individuals and enterprises

G Explain and compute the effects of customs duty on the business transactions of individuals and enterprises

H Identify and explain the obligations of tax payers and/or their agents and the implications of non-compliance.

RATIONALE

This syllabus introduces candidates to the subject of taxation and provides the core knowledge of the underlying principles and major technical areas of taxation,as they affect the activities of individuals and businesses.

In this syllabus,candidates are introduced to the rationale behind and the functions of the tax system.The syllabus then considers the separate taxes that an accountant would need to have a detailed knowledge of,such as the income tax liabilities of individuals,domestic corporate enterprises and foreign invested enterprises;the value added tax and turnover tax liabilities of businesses;and the land appreciation tax arising on disposals of property by both individuals and enterprises.

Having covered the core areas of the basic taxes,the candidate should be able to compute tax liabilities,explain the basis of their calculations,apply tax planning techniques for individuals and companies and identify the compliance issues for each major tax through a variety of business and personal scenarios and situations.